My question in last nights ZeroHedge debate

A lesson in a "crowded perspective"

While we finally got to see a real debate on the future of the U.S. Dollar, yesterday's ZeroHedge debate was a mixed bag.

On the stage right (left of the table as one views the screen) were Michael Every and Brent Johnson. I am familiar with Every of Rabobank from his frequent commentaries. I was not so familiar with Johnson. Stage left was Jim Rickards and Bob Murphy. Similarly, I have read Rickards’s work but was unfamiliar with Murphy. Kudos to Adam Taggart for his excellent moderation.

My hot take on the overall discussion can best be captured from the response to my question - which was the last one posed to the panel. (It is at about 2:41 in the video):

Every went first, and he clearly has lived (or lives) in Singapore. (Listen to what he says at 2:47. He’s got this part right. I have extended family in both Singapore and Kuala Lumpur.) But he didn’t quite catch the point I was making when he objected that the Singapore Dollar was not pegged to the USD. I said its monetary policy was pegged to the USD. Every accurately stated that Singapore uses the exchange rate of the Singapore Dollar against a secret basket of currencies. Those currencies and their respective weights are a state secret. Ultimately, however, Singapore measures the value of its “reserves” in USD - which goes to this whole question about the USD’s status as the world’s main reserve currency. The point here is to notice that regardless of whether a currency is actively “pegged” to the USD, it is largely irrelevant if the supply and demand of the currency is managed by buying into or selling from reserves valued in USD.

This goes to a fundamental reality about economics, markets, and finance. Consider:

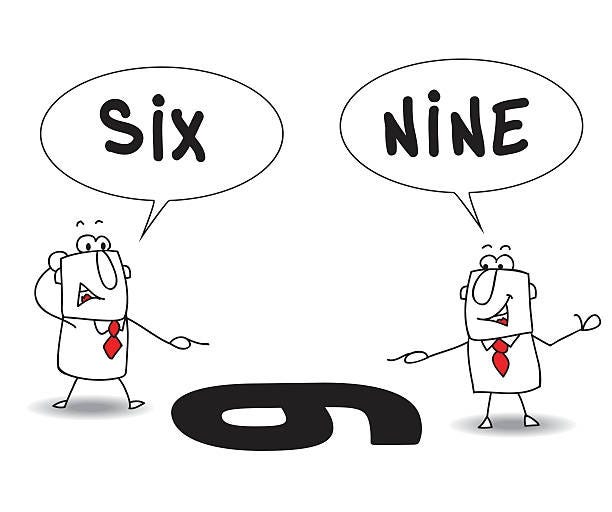

What you see depends on your perspective. For as smart and experienced as Every (and Johnson) are, I wonder if they have ever thought of extrapolating from a concept like a “crowded trade” to reflect on the risks of a “crowded perspective.” Think about this guy on the left and imagine market pros like Every and Johnson are alongside him, insisting it is a six. And then there are people like me opposite them saying: “Really?”

Why Singapore is the Canary in the Coal Mine

I’ll get back to this matter of perspective at the end. Just note how uncomfortable it can be to realize two people can look at the same thing at the same time, see something completely different, and both be right and wrong - at the same time. If the value of the Singapore Dollar is managed against other currencies by managing reserves valued in USD, I am sorry… as a matter of monetary policy, the Singapore Dollar is effectively pegged to the USD.

But this wasn't really my main point. When you look at Singapore’s tiny size and abject lack of natural resources, this chart should be quite surprising.

What is the Monetary Authority of Singapore (MAS) doing as the third largest buyer of gold? The answer can be found in a two-part series by Channel News Asia.

As for the series, this is the best available explanation of what these things called “reserves” are. It is the best precisely because it is written and produced for people who are interested in the subject but do not have a professional background in finance. (Read: People who have not been propagandized by way of degrees and credentials into how to think about these things.)

The first part explains the mechanics of what Every described - how the exchange rate is maintained by buying into or selling from reserves. If Singapore is the third largest Central Bank buyer of gold, it is certainly selling something else. We do not need to know what they are selling. If they are selling for USD to then buy Singapore Dollars to defend its desired exchange rate band, the Federal Reserve is ultimately the counterparty here.

The second part is a spectacular review of the history of Singapore and how it accumulated its reserves. It is especially worth listening to the decision-making that happened during the Great Financial Crisis.

But let’s get back to gold… The thing that makes all of this so notable (and worth asking the question last night) is the outsized ranking Singapore has had of late in terms of the MAS buying gold - outsized vis-a-vis Singapore as an economy. If we understand that having reserves in various assets - all valued in USD - puts the Singapore Dollar at counterparty risk over and against the Federal Reserve, then it would seem this outsized place among gold buyers explains itself: The greater degree to which Singapore reckons its reserves against gold as a unit of measure (not just gold as valued in USD) is the degree to which it is positioned to pivot in the event the USD loses its preference as a trade reserve.

What money as the “nine” looks like

Every seems to get the underlying realities. I just do not understand why he does not see their implications. Singapore has to import practically everything. (Every makes this very point at about 2:43) This means that the consumer price for practically everything includes the price of the currency by which these things are bought. Stop and think for a moment: If you buy something from Europe, that something is priced in Euros. But you do not pay for it in Euros. The importer does, though. And the foreign exchange cost of those Euros is built into the USD price you pay here.

This reality puts the Singaporean consumer in a very vulnerable position. But to appreciate the vulnerability, we have to look at money differently - meaning we need to step away from an overcrowded perspective and realize what we think is a six might really be a nine.

Money - when looked at from the perspective of a society where consumers are highly vulnerable to the effect of currency exchange fluctuations - is how we convert our labor to our living before it is any of the traditional three things taught to us in school: a unit of measure (or account), a store of value, and a medium of exchange. These three features of money are the “six” in the meme above. Money as a means to convert one’s labor to one’s living is the “nine.”

Overseas Dollars (e.g., Eurodollars)

It is maddening that Johnson does not see this. He points to the Eurodollar market as an example of the strength of the USD. But, being in their deeply disadvantaged position, what does the MAS see? Its outsized buying of gold answers the question. As the USD gradually loses its preference, the incentive to maintain USD balances overseas declines as well. Those USD will be converted into some other preferred monetary unit, depending on market segments and their needs. This conversion means these dollars surge into the U.S. domestic money supply, which will drive a spectacular new round of inflation. This will, in turn, drive interest rates completely out of the control of the Federal Reserve. What does that, then, do to a grossly over-leveraged U.S. banking system?

Hint: Silicon Valley Bank. Only this will not be confined to the small and medium sized banks. And if the Federal Reserve System itself begins to fail, what of its bank notes (i.e., the USD)?

By significantly increasing its reserve allocations in gold, Singapore seems to be preparing a counterparty-risk-free defense of the Singapore Dollar as the means by which the Singaporean people convert their labor to their living. If they buy Singapore Dollars to defend its value, they are not buying Singapore Dollars with Singapore Dollars. So, if they are buying Singapore Dollars with USD, they have to draw on their USD (denominated) reserves in some way. But in a for-real, no-shit banking crisis, there will be no way for Singapore to know how much the real-term purchasing power of the USD (or any other fiat unit) they will get when they sell from their reserves in order to buy Singapore Dollars.

Rather than merely setting up a counterparty-risk-disadvantaged fiat hedge, Singapore may be seeing a day in the near future when there will be no fiat currencies left standing that are perceived to be competently managed. And if Singapore leverages its decades-long record of competence to actually back the Singapore Dollar with gold (and other metals like silver), then it really is game over for the USD as the world’s trade reserve monetary unit. Singapore - of all countries - will be best positioned to issue the world’s trade reserve currency.

Why the Courts Matter

As part of my question, I observed that Singapore is the only country with a judicial system based on English common law. I was shocked to hear Every actually appeal to Hong Kong. Does he actually think a dispute in a court under the Chinese Communist Party will be adjudicated as we would otherwise expect based on our traditions of common law? Yes, Hong Kong’s legal traditions stem from the English tradition. But does the CCP social credit system somehow not apply to Hong Kong and its courts? Please.

This is also why the Chinese Yuan will never be widely adopted as a trade reserve currency. To what court will counterparties appeal in the event of a dispute? If they take the matter to a U.S. court, the judgment will not be in Yuan but in dollars. (For a lesson in legal tender and the court system, see ZH coverage of the FTX bankruptcy, where the parties are disputing the point in time at which the market exchange rate between crypto “assets” and the USD will govern what customers recover - in USD of course.) So what, ultimately, is the point of settling trade in a currency unless you also trust the court system of the country that issues that currency? Hong Kong? Again, please. Russia? You gotta be kidding me. Brazil, India, South Africa?

The reliability of the U.S. courts seems to be a side to the preference for agreements settled in USD that few have noticed. Wouldn’t it be nice to have fiscal and monetary competence here as well?

And then there is Singapore.

Brent Johnson’s Take

As I was listening to the debate, I was really confused by what seemed to me to be Johnson’s persistent misrepresentations of points Rickards, in particular, was making. Then he made a comment on the side, and it all of a sudden became clear (at least as far as my opinion goes) what was happening.

Johnson mentioned in a side conversation about gold and portfolio allocation that he was fortunate to be able to manage the money of a small number of very wealthy clients. And, of course, they measure their wealth in USD. A turn of phrase came to mind I once heard Jerome Powell say (I have not been able to find a link, but similar things are said in Federal Open Market Committee meeting minutes and elsewhere in the financial press:

When you talk to the people that matter on Wall Street, they talk their book; it’s just the way it is. - Jerome Powell

The real possibility of the USD losing its preference as the world’s trade reserve currency is manifestly not in the fiduciary interests of Johnson’s client. And so he “talked his book.”

There were quite a few points he made that made no sense as he tried to talk right past the points Rickards was making. Here are a couple:

Johnson claims he can show charts that prove that when fiat currencies all encounter trouble, as far as comparative price pairs, the USD always rises. I could not help but laugh. Anyone old enough to remember the Great Financial Crisis should laugh every time a market pro even so much as breathes the words never or always. We were told the real estate market never collapsed across the country all at once. And then it did. The USD always rises in a crisis? Sure, until it doesn’t. But it was his appeal to charts that really caught my attention.

The X-axis on his chart will certainly be time. The Y-axis? If it is not gold or silver, it will have to be USD or some fiat against which he pairs the USD. What happens when all fiat units collapse under the same weight of bad debt? (I just love Wall Street’s opaque euphemisms - they call these “non-performing loans” or “junk bonds” - just anything other than what they really are - bad debt.) We are well past the time when the Fed (or the ECB or BOJ) can print money to paper over this burden. There is no runway left, not even with what little of the balance sheet the Fed has soaked up. This realization explains Singapore’s pivot to gold. Johnson wants to - no, needs to - pretend the fiat USD still has objective merit as a unit of measure at the Y-axis of his charts. And if it doesn’t, exactly what knowledge does he think those charts contain?

Where this really went off the rails to the point of offending me was Johnson’s (and, to a certain extent, Every’s as well) belief that U.S. military power ultimately is what will preserve USD hegemony. First, the emotional response: Will Johnson be signing up to fight? Does he have kids that will end up conscripted in a general mobilization? (I do - two boys in their mid-twenties.) It was absolutely shocking having to listen to him cavalierly assure the audience their wealth was safe in USD-denominated assets because he seemed to expect we would wage war if needed to defend USD hegemony. But let’s put aside the emotions. US military power has historically been naval combat power used to deliver expeditionary combat power (U.S. Marines) to secure our ability to trade freely - not to guarantee financial hegemony.

It was only when we decided to extort an “exorbitant privilege” from the House of Saud and that the USD was “…our currency, but your problem…” that the need to become a financial hegemon emerged. Johnson has not even come close to getting his head wrapped around what Vladimir Putin really just said (between the lines) to Tucker Carlson (and the rest of the West): “It’s our energy, but your problem.” Beyond needing to answer for exactly who will bear the burden of fighting, Johnson needs to explain - beyond occupying and ruling distant lands, as we have tried and failed numerous times (as Rickards tried to point out) - exactly how he sees the U.S. paying for the military power to secure financial hegemony once there is no one left to bail out fiat regimes? The best that can be said is Johnson’s historical education is sorely lacking; the history of money is the history of war, and the history of war is the history of money. King Charles I needed money to pay his soldiers to fight the Second Bishops War. He resorted to confiscating gold coins that had been minted from English merchants’ gold. What, exactly, does Johnson think the US will use to pay for the war needed to defend fiat USD hegemony in a full-on fiat crisis?

The Importance of Perspective

It probably bastardizes the quote, but someone once noted how hard it is for someone to comprehend something when his own living depends on him not understanding it. Every and Johnson spent almost three hours whistling past the USD’s grave. Beyond what I have tried to explain about seeing a “nine” above, here are a few other core differences in perspective when you haven’t spent your entire adult life in finance:

I have spent my career writing code and now run a cybersecurity business. In short, I am the kind of person guys like Every and Johnson depend upon to acquire data, bring them into context as information, and then provide useful mathematical analyses to produce a knowledge product. That knowledge then informs decisions about what to do with money over time.

At its simplest, this data-to-information-to-knowledge process produces a chart. There is an X-axis unit of time and at least one Y-axis unit used to measure value. One or more line series then expose value patterns over time that can be modeled into predictions. However, a problem emerges when there is a mismatch between the X and Y axes. And by mismatch, I mean the reasonably obvious reality that time is immutable. You cannot add to or subtract from a unit of time once that time passes. At the birth of the USD (the Coinage Act of 1792, for all intents and purposes), the USD enjoyed the same attribute - immutability. This was because the USD had a price by weight of silver. The US Eagle was equivalent to $10 and had a price in gold such that, as money, one unit of gold was equivalent to 15 units of silver. You could bring silver bullion to the Mint, and it would assay, melt, and strike it into USD coins for you. You could literally create USD, and the price to do so was measured in silver. Silver does not rust, and therefore, its weight does not dissipate. Silver (and gold) are immutable in terms of their weight. Then, having a weight-based price in gold and silver, the USD was a proxy for the metal and, as such, was also immutable as a unit of measure!

Let’s pause here to note what it means to see a “nine” where Every/Johnson sees a “six.” The idea that gold and silver have a floating price in USD is the central conceit of this upside-down, 50-year-old Alice in Wonderland economy we have been propagandized into thinking is right side up.

Back to Johnson and the supposition that his charts tell us something useful. The mismatch here is between the immutability of time as a unit of measure and the increasingly untethered supply of USD. Prior to the dot com crash in 2000, we had a semblance of sound monetary policy - which is to say the money supply had at least some reasonable tie to economic production. Then Clinton-Gingrich sowed the seeds for the irrational exuberance of the dot com bubble. From that point on, the USD money supply was increasingly divorced from any real economic production, and the reporting of the circulation of USD in the economy was increasingly divorced from the economic realities of converting one’s labor into one’s living.

But there that thing is - right there on the Y-axis of Johnson’s charts - the USD. Utterly lacking in any first principles, objective merit as a unit of measure to be paired with time to present value patterns such that we might discover knowledge in those patterns.

Let me leave with this. In 2005 Steve Jobs addressed the graduating class at Stanford. I put a saying from this speech on my email signature: Don’t be trapped by dogma, which is living with the results of other people’s thinking. Listen to the speech. In particular, listen to Jobs tell of dropping into a calligraphy class. All of a sudden, from the aesthetic perspective of typography, he sees the computer as something completely different than the rest - crowded into the engineering perspective as they were.

The rest, of course, is history.